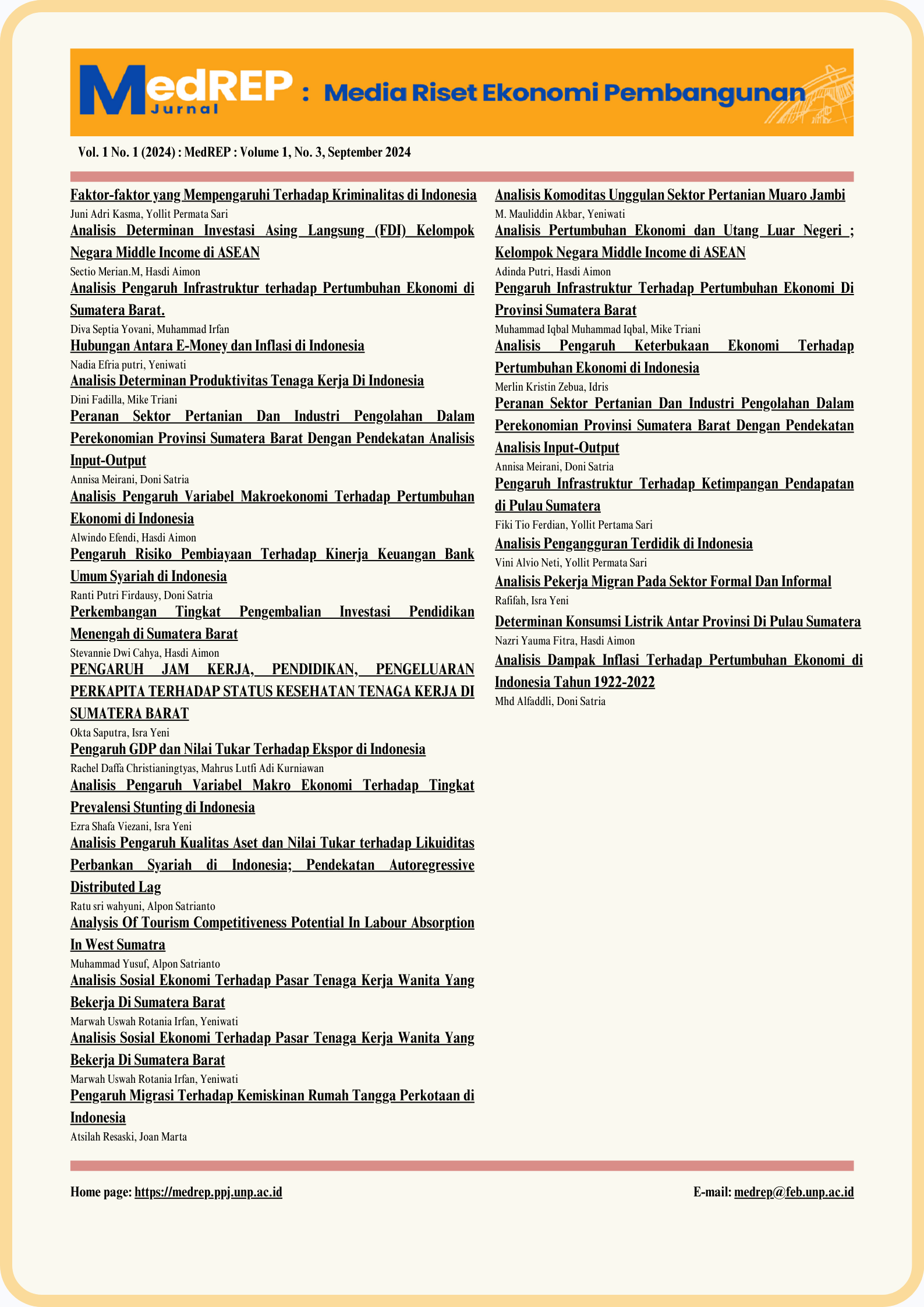

Hubungan Antara E-Money dan Inflasi di Indonesia

Keywords:

Inflasi, electronic money, quasi money, exchange rateAbstract

This study aims to determine; (1) The relationship of e-money to inflation in Indonesia in the long and short term, (2) The relationship of quasi money to inflation in Indonesia in the long and short term, (3) The relationship of the rupiah exchange rate to inflation in Indonesia in the long and short term. This type of research is descriptive using monthly data from 2013-2022. This study uses the Vector Error Correction Model (VECM) analysis method. Based on the results of the analysis and hypothesis testing in this study. In the long term, e-money and quasi-money variables show a significant negative relationship to inflation, while in the short term the relationship is not significant. In the long run the exchange rate shows a significant positive relationship to inflation while in the short term the relationship is not significant to inflation. It is expected that the Indonesian government and Bank Indonesia must be committed to developing a policy mix regarding digital finance, especially in payments using e-money. E-money is a new product in the financial world and its use is still uneven, so it still requires adjustment for the economy to respond well.

1.png)